Adani Group will redeem pledged shares before maturity, announced prepayment of more than one billion dollars

Adani Group Amidst the turmoil in the shares after the Hindenburg controversy, Adani Group has decided to redeem the pledged shares of its three companies. For this, more than one billion dollars will be paid by the group.

Adani Group announced on Monday that a pre-payment of $ 1,114 million (Rs 9,217 crore - in Indian currency) will be made by the promoter to withdraw the pledged shares of group companies. This payment is being made when the maturity of the loan against the shares is being held on September 2024.

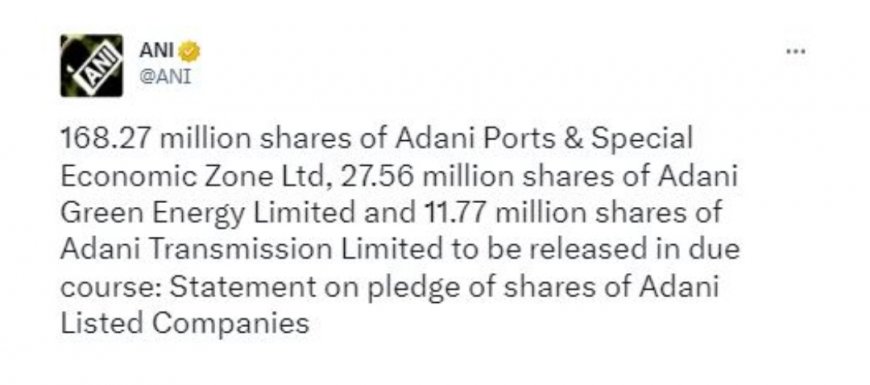

It was told on behalf of the group that these shares belong to Adani Port and Special Economic Zones, Adani Green Energy and Adani Transmission. Along with this said that the promoters of the group have assured to make prepayment towards the loan taken by pledging the shares.

Adani Group issued a statement

In a statement issued by Adani Group, it was said that in view of the turmoil in the market and showing Adani Group's commitment to reduce the leverage in the listed companies, the promoters have decided to withdraw the prepayment of pledged shares with maturity of September 2024.

The decision on the pledged shares by Adani Group is being considered very important. This has been taken at a time when there have been allegations of manipulation of share prices by the American research firm Hindenburg.

How many shares will Adani Group redeem?After this pre-payment, Adani Port & Special Economic Zones will hold a total of 16.82 crore shares or 12 per cent of the total shares of the Company, 2.75 crore shares of Adani Green or three per cent of the total shares of the Company and 1.17 crore shares of Adani Transmission or 12 per cent of the total shares of the Company. 1.4 percent of the total shares came back to the promoters will go.